WHAT SERVICES DO WE OFFER

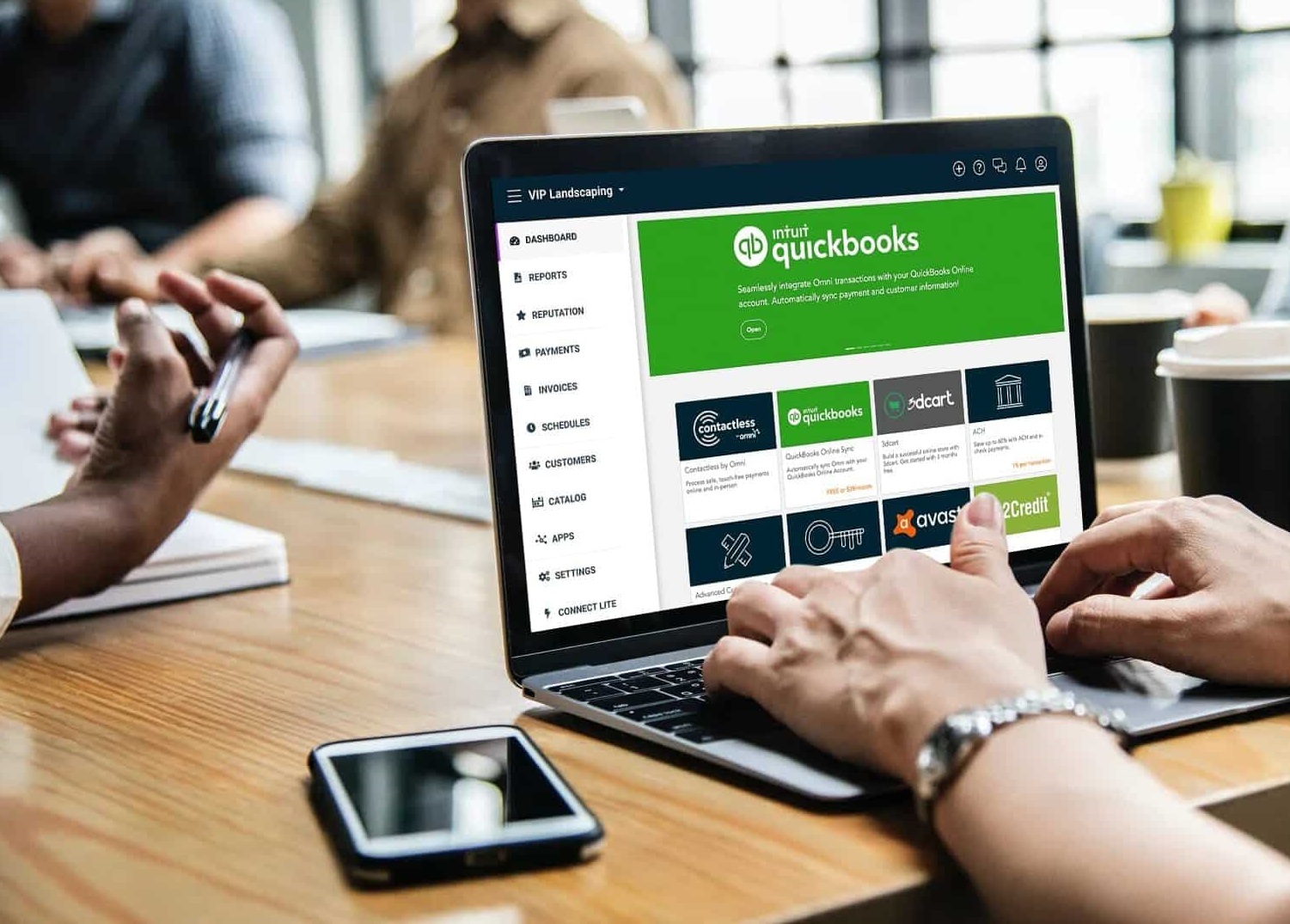

- Provide online, remote, virtual bookkeeping services via Quickbooks online

- Implement, organize and maintain company data files and financial processes so you don’t have to

- Manage your chart of accounts

- Track income and expenses for a clean P&L and Balance Sheet

- Manage receivables and payables for an up to date cash position

- Perform monthly bank and credit card reconciliations

- Create and send you financial statements each month

- Help to manage sales tax and process returns

- Analyze what you’re spending vs what you’ve budgeted

- Coordinate payroll with payroll companies

- Training for QuickBooks

- Historical catch-up and clean-up

…and I will work directly with your CPA to provide info for your tax returns

services

- Provide online, remote, virtual bookkeeping services via Quickbooks online

- Implement, organize and maintain company data files and financial processes so you don’t have to

- Manage your chart of accounts

- Track income and expenses for a clean P&L and Balance Sheet

- Manage receivables and payables for an up to date cash position

- Perform monthly bank and credit card reconciliations

- Create and send you financial statements each month

- Help to manage sales tax and process returns

- Analyze what you’re spending vs what you’ve budgeted

- Coordinate payroll with payroll companies

- Training for QuickBooks

- Historical catch-up and clean-up

…and I will work directly with your CPA to provide info for your tax returns

- Provide online, remote, virtual bookkeeping services via Quickbooks online

- Implement, organize and maintain company data files and financial processes so you don’t have to

- Manage your chart of accounts

- Track income and expenses for a clean P&L and Balance Sheet

- Manage receivables and payables for an up to date cash position

- Perform monthly bank and credit card reconciliations

- Create and send you financial statements each month

- Help to manage sales tax and process returns

- Analyze what you’re spending vs what you’ve budgeted

- Coordinate payroll with payroll companies

- Training for QuickBooks

- Historical catch-up and clean-up

…and I will work directly with your CPA to provide info for your tax returns

WHAT INDUSTRIES NEED A BOOKKEEPER

SKILLED TRADES

Plumbers, electricians, carpenters, need to manage their finances, track income and nsure accurate tax reporting. even if they are operating as a small, independent business; essentially, any business needs a bookkeeper to maintain financial health and make informed decisions.

CONSULTANTS

Proper financial record keeping is crucial for consulting businesses. Without an accurate picture of the numbers, strategic decisions suffer and come tax time you’ll be scrambling. Finally you can get organized and ensure your business runs smoothly all year.

HEALTH PROFESSIONALS

Healthcare practices must adhere to strict financial reporting requirements and healthcare billing can be intricate with different insurance companies and codes, requiring specialized bookkeeping knowledge to accurately track payments and claims.

BUSINESS OWNERS

For accurate transaction recordings, reconciling accounts, generating financial reports, and ensuring compliance with tax regulations, bookkeepers allow business owners to focus on operations and growth instead of managing day-to-day financial details.

INVESTORS

We help real estate investors with cash-flowing assets protect & understand their finances, without forcing them to spend hours at their desk on Quickbooks.

RETAIL + WHOLESALE

Time is money and it’s all about the money! That’s why we help Retailers and Wholesalers get out of the office and back to building their businesses.

THERAPISTS

Your passional lies with your clientele, not spreadsheets. I will help keep everything in clear and ordering reports so there will be peaceof mind and the ability to focus.

COTTAGE INDUSTRY

If you think record keeping is not as important and you can use the same bank account for personal and your part time at-home creative operation. Don’t learn the hard way!